A version of this article appeared in the Los Angeles Sentinel.

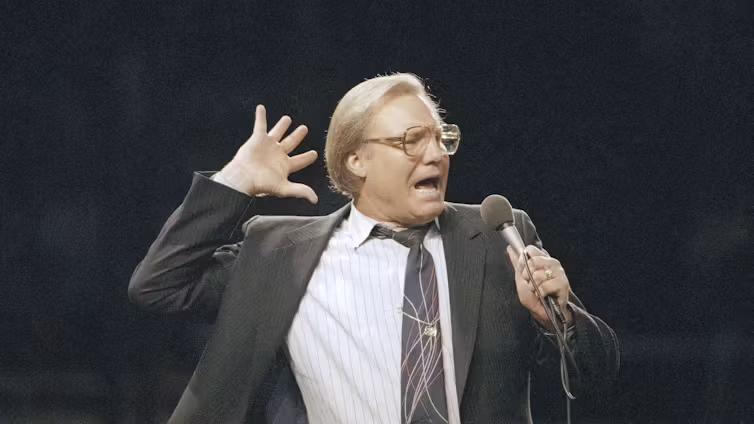

Churches are required to be transparent and fiscally accountable and to work together to manage God’s money. But too many churches fail to show members the money. And when money is funny, then the begging starts. If you don’t want money to stop flowing to the church, then church leaders need to show members where the money is being spent. The pastor, deacons, stewards, trustees, ministry leaders and pew warmers have a fiduciary responsibility, which means it’s time to show members the money.

Where is the money going? The IRS Tax Guide for Churches and Religious Organizations requires faith-based groups, like many other charitable organizations, to qualify for exemption from federal income tax under IRC section 501(c)(3), and they are generally eligible to receive tax-deductible contributions. One method of qualifying for tax-exempt status is if net earnings may not accrue to the benefit of any private individuals (i.e. the pastor, deacon or other congregational leader) and if the organization’s purposes and activities are not illegal or otherwise in violation of public policy. The Federal Government is one of the church’s greatest contributors in that churches don’t pay income taxes on tithes and offerings. Therefore, the church benefits if it qualifies for 501(c)(3) status. Does your church have an open book policy to show members the money?

The Federal Funding Accountability and Transparency Act (FFATA) was signed on September 26, 2006. The intent of the legislation is to empower every American with the ability to hold the government accountable for each spending decision. The goal is to reduce wasteful spending in the government, reflecting the Obama administration’s commitment to creating an unprecedented level of openness in government.

Yet some churches fail to practice openness in their financial processes. The church should have nothing to hide. All members should be welcome to see the record of contributions, expenses, properties and equipment owned by the church, and top church leaders’ compensation packages. The church should have regularly scheduled meetings reporting on all income, expenses and church properties. This would help end unnecessary spending and poor money management. What does the church have to hide? After all, churches are held to a standard of accountability beyond tax laws.

In the next two installments of this three-part series, we will outline methods of church budgeting as well as financial reporting to the board and membership, along with how to develop a plan to raise money from non-members. Remember, every member has a right to see the church books. Every member has a right to expect financial transparency, accountability and the opportunity to see the money.

At a time when many churches in our community are struggling to achieve fiscal stability, moving toward transparency is a first step toward realizing the promise of Romans 8:28: “And we know that all things work together for good to them that love God, to them who are the called according to his purpose.”

Photo Credit: Stockmonkeys.com – Chris Potter/Flickr

Mark Whitlock is a contributing writer for the USC Center for Religion and Civic Culture.