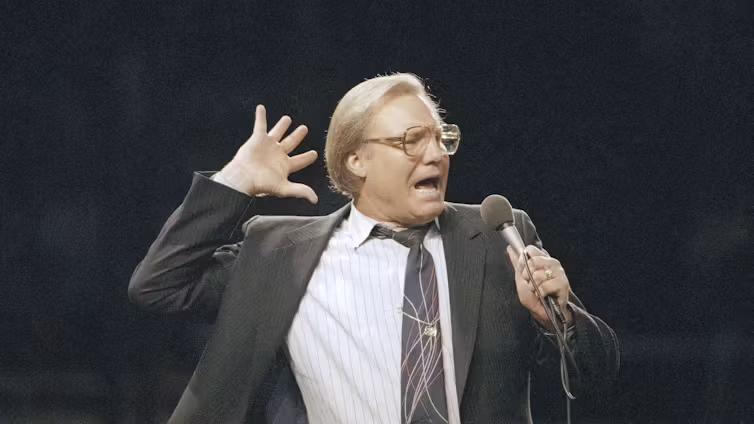

“Dream big and love big,” Rev. Cecil Murray told faith leaders and businesspeople gathered at the University Southern California for the third annual Faith-based Small Business Summit. The summit, themed “where the mission meets the marketplace,” aimed to help attendees succeed in their endeavors and give back to the community.

The Cecil Murray Center for Community Engagement co-hosted the gathering of about 375 with the USC Small Business Diversity Office.

Small business owners in minority communities struggle to access the funding, contracts, tools and skill sets they need to sustain themselves over time, Rev. Najuma Smith-Pollard, program manager at the Cecil Murray Center, explained. “Some small businesses are run by an individual who has a dream or idea but they don’t have the capacity to make it work.”

After Murray offered his inspirational message in the invocation, Smith-Pollard moderated a panel on the practical issues of raising capital for businesses and non-profit organizations.

Post recession, there has been a sharp decline in small business loans to the African-American community, Sharon Evans, CEO of the Business Resource Group, pointed out during the panel. She has made it her mission to restore equity in access to capital.

But in order to qualify for a loan, businesses need to show that they have the ability to use those funds well, panelists agreed.

Capacity is the No. 1 factor that funders look to when determining whether to grant money to an organization or business, Rev. Mark Whitlock, executive director of the Murray Center, said. Other panelists shared the “5 C’s of credit,” which also include collateral, character, capital and conditions—with cash-flow a sixth.

Faith-based nonprofit organizations can help small business owners through entrepreneurial and financial literacy training programs, as well as micro-lending programs. “We all have entrepreneurs in our congregations,” Smith-Pollard explained after the event.

Still, nonprofits must be able to show results, too.

A majority of the audience raised their hands when Claudia Viek, CEO of CAMEO, asked their interest in starting micro-lending programs. People in faith-based organizations know the needs of their community, she said, and can collaborate across the nonprofit and business worlds to meet those needs. For instance, micro-lender ACCION San Diego partners with a small business development center to help their businesses build capacity to succeed.

Whitlock pointed to his church’s community development corporation as another example of collaboration. The Christ our Redeemer Community Development Corporation (COR CDC) works with Vander Capital Partners to buy and refurbish apartment buildings. Vander Capital Partners pays COR CDC to provided social services in the building, benefiting from a community development tax credit. COR CDC also owns 1 percent of the buildings and pays rent to the church as it operates out of its facilities.

A small and medium-size nonprofit that has never worked on a development wouldn’t be able to access funds without such a partnership.

“Capacity and collaboration are the keys,” Smith-Pollard concluded, summarizing the panel.

Other panels during the daylong summit discussed social enterprises and tax issues. Keynote speaker Beverly Kuykendall, president of the American Medical Depot, addressed the connections between the faith-centered businesses and federal procurement initiatives, and how these, together, present the opportunity to have meaningful economic impact to local communities.

The U.S. Small Business Administration, the Office of Councilman Curren D. Price, Jr. and AmPac Tri-State CDC, Inc. also partnered on the event.

The Cecil Murray Center for Community Engagement provides a financial literacy and capacity building training to help faith leaders support entrepreneurs in their communities. To find out more information about the next training, please sign up for our newsletter, and indicate your interest in the Murray Center.