In disadvantaged communities, economic instability makes it difficult for many to access important financial knowledge. Without this information, people cannot lift themselves up and grow their wealth. And if the people are poor, the church will be poor.

For this reason, a wealth-building ministry is extremely important in the development of a strong church. Creating or expanding this service allows faith leaders to build up their church community.

The typical funding model of tithes and offerings has led many churches to focus on money collection, but without encouraging the church’s members to grow their own wealth. This strategy will never succeed in growing the church–in order to build the wealth of the church, leaders must first build the wealth of the entire community.

Sometimes the leadership of a church sees only the spiritual needs of the church’s members, but civic and economic development can be just as important as spiritual development. Educating church leaders and members about financial tools for success—such as saving and investment accounts or home and business loans—will build a stronger and more powerful congregation as a whole.

It is critical to find resources within both the church and the wider community. Here are some of the most important steps for congregational leaders to create a strong wealth-building ministry at their churches:

- Find people in the congregation who have worked in the financial arena (insurance industry, banking, real estate or retirement firms, for example). These people can teach their fellow church members about their expertise. Always look within the congregation first. Sometimes you may discover the skills you need were there all along. Using the skills of those who are already involved and passionate about your organization can be a fantastic tool for congregational wealth-building.

- Find local bank branches that your church can partner with for financial training and services. Look up the three closest bank branches to your ministry and map them from closest to farthest. Research whether the bank branch reflects the community in which your church is located. If your ministry and community is majority-minority, does the staff at your local branch reflect this demographic profile? This is extremely important because the bank should work for the community. If community members do not feel the bank represents them, they may feel uncomfortable getting the help they need from the institution. Ideally, find a bank that matches the demographic makeup of your church community.

- If no bank branches match the demographic makeup of your community, as often is the case, form a relationship with the bank anyway. This relationship will allow you to begin an open dialogue about the staffing profile of the bank in order to facilitate change. By interacting with the bank, you can help the bank better understand the community and change its hiring practices, and help your community form a relationship with the bank. Empower members of your congregation to trust and communicate with their local bank, and this will lead to greater economic empowerment.

- Determine which local bankers are willing to teach financial literacy for community service hours, which banks are required to complete. By providing an opportunity for the bank to fulfill these hours, you can create an even stronger relationship between the bank, the church and the community. Then when exciting opportunities for investment come up, the banker will be more likely to share these with the community. Members of your congregation will also feel more comfortable in their local bank, since they will be familiar with some of the bankers.

- Locate outside resources and potential partners for collaboration, such as fraternities, sororities, non-profits or networks like 100 Black Men of Los Angeles. Encourage members of your community to share the other organizations and communities they are involved in. You cannot be sure which local organizations reflect your values until you interact with them. Build bridges between organizations and encourage organizational sharing. Allow and encourage members of your community to share their wealth of knowledge and experience.

Once you have gathered your resources, you will need to put together a financial literacy program. Have a volunteer coordinate the program. They will have to determine the following:

- What are the goals of the financial literacy program? Increase savings rates within the congregation? Help people buy a home or start a business? This will help determine the content of the financial literacy sessions.

- How often will your financial literacy programs run? Weekly, monthly, quarterly? The frequency of your program will determine the efficiency of your program. Schedule sessions in advance to help the program stay on track.

The program has started. Now, it is time to record information about your program.

- Track who attends your programs and document their demographics. This will also allow you to build a stronger program over time and tailor the program to match the needs of attendees. Are you serving young people, new parents, retirees?

- Document what is discussed in each session and determined which teaching strategies are most effective. Welcome feedback from participants. Always be prepared to grow, change and innovate in order to answer the needs of the congregation.

- Track results and create a system that helps participants hold themselves accountable to their own goals, and that also shows the success of the program. Be sure to share these stories of success within your ministry and the wider community.

Finally, you can seek additional funding for your financial literacy program. As your program grows, apply for grants to continue to expand. The information you have gathered on the number of participants, their demographic profile, their needs and initial successes will help you show potential funders, including foundations and banks, that you have the capacity to meet a critical need in your community.

Your example will also make you a leader in the community, encouraging other churches to create or expand their own wealth-building ministries. Growing a strong wealth-building ministry will empower and strengthen the church and the church community. Don’t hesitate–you have the resources to start today.

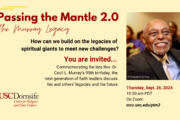

The USC Cecil Murray Center for Community Engagement offers wealth-building workshops within faith communities throughout the Los Angeles area. Click here to find out about future workshop dates, and email crcc@usc.edu if you are interested in hosting a workshop in your community.

Rev. Frank Jackson, Jr. is a contributing fellow with the USC Center for Religion and Civic Culture.

Donald Cook II is a guest contributor with the USC Center for Religion and Civic Culture.